Welcome to Bridgehead Corporate’s second monthly news roundup that explores and analyses the trends in the coverage of offshore financial centres (OFCs) in the media landscape throughout June.

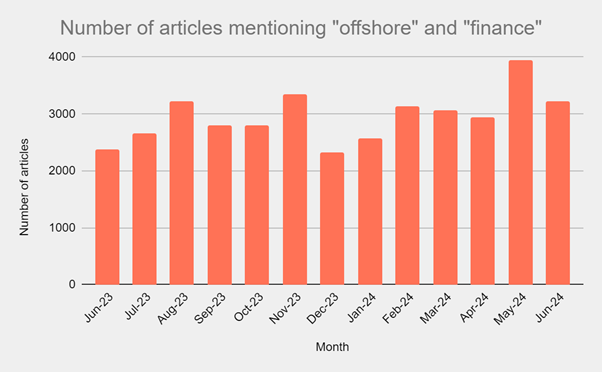

In June, there were 2,380 mentions of “offshore” and “finance” in the global media, an 18 per cent decrease on recorded mentions in May. This decrease is a result of the shift in media focus on other economic issues, for example, the Federal Reserve’s announcements regarding interest rates and economic outlooks dominated financial news. May’s surge in mentions was also likely driven by an increase in regulatory scrutiny and international actions targeting OFCs.

The figures for this June also represent a 26 per cent decrease on last June.

The chart below plots the number of articles mentioning “offshore” and “finance” in the media over the last twelve months.

Throughout June, there was a continued focus on the strategic movements and regulatory challenges faced by OFCs. The coverage reflects the evolving international landscape as low tax jurisdictions navigate global economic shifts and regulatory scrutiny.

The Cayman Islands Government officially opened its Asia office in Singapore, marking its third overseas office following openings in London and Washington DC. This move aims to strengthen Cayman's business presence and facilitate ventures in the Asian market.

Luxembourg's international competitiveness continues to decline, as evidenced by its further drop in the IMD World Competitiveness ranking. Falling from 16th place in 2023 to 23rd in 2024, Luxembourg has seen a significant deterioration in its "economic performance" ranking, plummeting 55 places over two years. This trend demonstrates the challenges Luxembourg continues to face in maintaining its status as a competitive financial hub.

India received the highest foreign direct investment (FDI) from Singapore in 2023-24, despite an overall decline of almost one third in FDI from Singapore. Mauritius emerged as the second-largest investor.

Meanwhile, as the era of ‘tax havens’ wanes, some are claiming that Mauritius is facing the need for a new economic strategy. The country's economic growth, heavily reliant on its offshore sector, is being challenged by recent global initiatives such as the multilateral convention to implement tax-related measures. These changes significantly limit the benefits previously available under double taxation avoidance agreements, suggesting Mauritius should seek new growth avenues.

Finally, Luxembourg also witnessed a decline in FDI related to special purpose entities (SPEs). The European Central Bank data from Q4 2023 indicates substantial withdrawals. This trend reflects the ongoing transformation within Luxembourg's financial sector as it adapts to changing global economic conditions.

Top Stories

Below are our top five stories of the month.

Captive Insurance Times - Cayman opens Asia office in Singapore

The Cayman Islands Government has officially launched its Asia office, based in Singapore, aiming to bolster its presence and facilitate business ventures in the region. Headed by the government’s overseas representative to Asia, Gene DaCosta, the Asia office is one of three overseas offices of the Cayman Islands. The Europe office, based in the government's longstanding London office premises, began operating in March this year, and the Washington DC office opened in December, 2022.

Delano - Luxembourg slides further in international competitiveness ranking

After losing seven places in 2023, Luxembourg has fallen a further three places to 23rd in the IMD World Competitiveness ranking. Among the 336 indicators, “economic performance” has fallen 56 places in two years. Between 2023 and 2024, Luxembourg fell 18 places in the “economic performance” ranking, according to the IMD World Competitiveness, published in conjunction with the Chamber of Commerce. The 18 places are in addition to the 37 lost the previous year, for a total of 55 over two years, in a category which Luxembourg was number 1 in the world in 2022.

The Hindu - India receives highest FDI from Singapore in 2023-24; Mauritius second biggest investor: Government data

India received the highest foreign direct investment (FDI) from Singapore in 2023-24 even as overseas capital inflows into the country contracted by about 3.5 per cent due to global economic uncertainties, according to the latest government data. During the last fiscal, FDI equity inflows decreased from major countries, including Mauritius, Singapore, the U.S., the U.K., UAE, Cayman Islands, Germany, and Cyprus. FDI from Singapore has dipped by 31.55 per cent to $11.77 billion

The Conversation - Mauritius’ next growth phase: a new plan is needed as the tax haven era fades

For the last two decades, Mauritius’ economic growth has depended heavily on its offshore sector – the provision of financial services by banks to foreign firms. But recent initiatives have dimmed prospects for the offshore sector. For instance, the multilateral convention to implement tax related measures significantly limits the incentives available under double taxation avoidance agreements.

Delano - FDI declines in Luxembourg as SPEs withdraw investments

Luxembourg’s financial sector is witnessing significant changes as special purpose entity-related foreign direct investments move out. Q4 2023 saw the largest withdrawals, according to data from the European Central Bank, reflecting broader adjustments in multinational operational strategies.