Welcome to Bridgehead Corporate’s latest monthly news roundup of 2024 that explores and analyses the trends in the coverage of offshore financial centres (OFCs) in the media landscape throughout July.

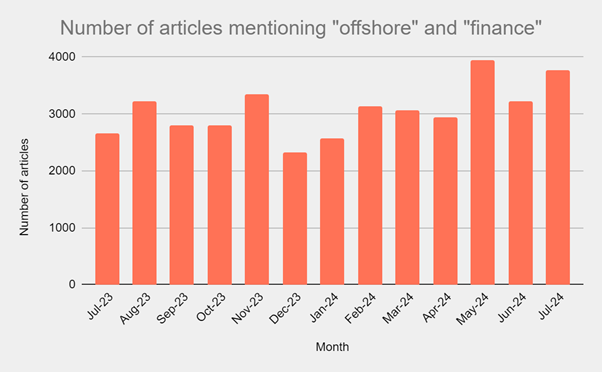

In July, there were 3,769 mentions of “offshore” and “finance” in the global media, a 17 per cent increase on recorded mentions in June. This increase reflects the release of economic reports, such as the IMF’s World Economic Outlook, and changes in global financial trends, such as shifts in investment strategies and the performance of international markets.

The figures for this June also represent a 42 per cent increase on last July.

The chart below plots the number of articles mentioning “offshore” and “finance” in the media over the last twelve months.

This July has seen heightened speculation among British overseas territories and crown dependencies regarding the impacts the new Labour administration will have on their respective jurisdictions. Global rankings have also been released this month, revealing both the largest OFCs and the leading destinations for foreign portfolio investment (FPI).

For BBC News, Jonathan Morris reports that people with assets in the Channel Islands are bracing for potential tax changes under the new Labour-run UK Government. Finance experts speculate that Labour, which secured a decisive majority in the UK General Election, may adopt a stricter approach to taxing offshore assets.

The election of the Labour Government has also raised concerns in the Cayman Islands regarding future policies. James Whittaker notes in Cayman Compass that upon taking office, Foreign Secretary David Lammy contacted the Cayman Islands to discuss the aftermath of Hurricane Beryl and to assure the UK government's continued support. However, there is apprehension about Labour's historical stance towards offshore financial centres, which has been more critical compared to the Conservatives.

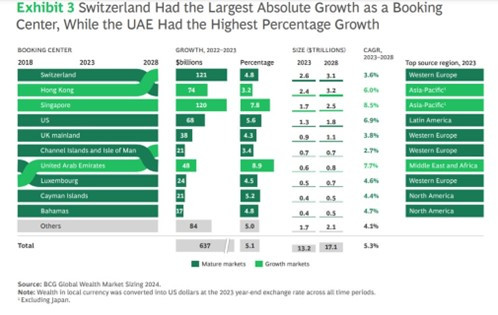

Despite global pressures, a report by Boston Consulting Group reveals that Switzerland continues to dominate as the world's largest offshore financial centre, with Hong Kong holding the second position and the UAE rapidly expanding its influence.

In a notable shift in the landscape of FPI, data from the National Securities Depository highlights that Ireland has overtaken Mauritius to become the fourth most preferred FPI destination for funds routed into India. As of June 30, Ireland's assets under custody (AUC) stood at Rs 4.41 trillion, slightly surpassing Mauritius, which recorded an AUC of Rs 4.39 trillion. Ireland's attractiveness continues to grow while Mauritius is experiencing a relative decline in the competitive FPI market.

Finally, Hui Ching-Hoo reports that Hong Kong's Financial Services Development Council (FSDC) has called on the government to enhance its offshore renminbi (RMB) business to solidify the city's role in China's dual-circulation policy. This strategy focuses on boosting domestic consumption while remaining open to foreign investment. The FSDC's recommendations aim to strengthen Hong Kong's status as an international financial centre by capitalising on its unique position as a connector between mainland China and global markets.

Top Stories

Below are our top five stories of the month.

People with assets in offshore trusts in the Channel Islands may end up paying more tax under the new Labour-run UK Government, a finance expert believes. There had been speculation that Labour, which won a decisive majority in the UK General Election, could take a stricter approach to tax on such assets. Andy Shaw, a tax director at Grant Thornton in Jersey, said trustees would be watching "very closely" what happens.

Wealth Briefing Asia - Global Wealth Recovered In 2023; Switzerland Remains Top Cross-Border Centre

For all the pressures it has been under, Switzerland remains the world's largest offshore centre, with Hong Kong in second place, while the UAE is expanding rapidly. Global financial wealth rose by almost 7 per cent in 2023 to $275 trillion, almost reversing the 4 per cent drop in 2022 when markets took a tumble and an estimated $92 trillion in financial wealth is likely to be created in the next five years, according to Boston Consulting Group in a recent report.

Cayman Compass - As Labour takes the reins in the UK, what does it mean for Cayman?

When Foreign Secretary David Lammy took office after Labour’s historic landslide victory Friday in the UK general election, one of his first calls was to the Cayman Islands to check on the impact of Hurricane Beryl and pledge support to the territory. Observers in the overseas territories could be forgiven for a touch of trepidation about the new government’s approach on a couple of key issues that impact Cayman. Historically the party has taken a more hostile stance towards offshore financial centres than the Conservatives.

Business Standard - Ireland pips Mauritius to 4th spot on preferred FPI destinations list

Mauritius, once among the leading destinations for foreign portfolio investors (FPIs) routing funds into India, has now slipped to the fifth position, behind Ireland, in terms of assets under custody (AUC) as of June 30. At the fourth position, Ireland boasted an AUC of Rs 4.41 trillion, slightly more than Mauritius, which recorded an AUC of Rs 4.39 trillion by the end of June 2024, according to data from the National Securities Depository (NSDL).

Asia Asset Management - Hong Kong think tank urges government to boost offshore RMB business

Hong Kong’s Financial Services Development Council (FSDC) is calling on the government to enhance the offshore renminbi business to entrench the city’s role as a “connector” for China’s dual-circulation policy, Beijing’s strategy to reorient the economy by prioritising domestic consumption while remaining open to foreign investment. The recommendation was among several that the FSDC, the government’s financial think tank, made over the course of its last financial year, aimed at strengthening Hong Kong’s status as an international financial centre.