Welcome to Bridgehead Corporate’s first ever monthly news roundup that explores and analyses the trends in the coverage of offshore financial centres (OFCs) in the media landscape throughout May.

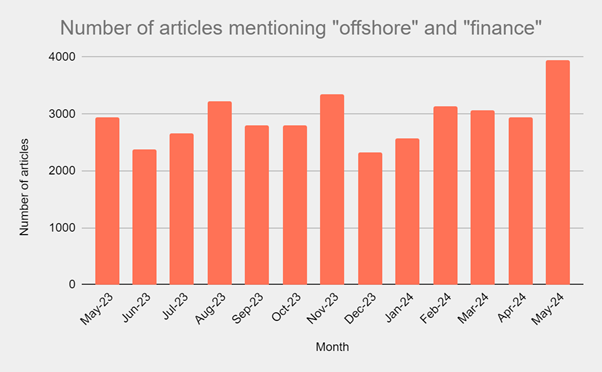

In May, there were 3,953 mentions of “offshore” and “finance” in the global media, a 35 per cent increase on recorded mentions in April. This increase can be attributed to increased regulatory scrutiny and debates over tax neutrality.

The figures for this May also represent a 34 per cent increase on last May.

The chart below plots the number of articles mentioning “offshore” and “finance” in the media over the last twelve months.

Throughout May, there was a significant focus on regulatory changes and economic developments in various OFCs. These updates highlight the ongoing efforts of several jurisdictions to align with international standards and attract foreign investment amidst increasing global scrutiny.

The Channel Islands announced their decision to implement the ‘pillar two’ tax for large companies, aligning with a global tax reform aimed at curbing profit shifting and ensuring a minimum tax rate of 15 per cent for multinational enterprises with a turnover of more than €750 million from 2025. This move is expected to enhance the islands’ reputations and demonstrate their commitment to international tax norms.

In a critical commentary on the British Virgin Islands (BVI), social commentator Claude Skelton Cline pointed out the increasing difficulties of doing business in the territory. He highlighted bureaucratic obstacles and red tape as major challenges stifling entrepreneurial growth and innovation. He called for a more efficient system to support local businesses and drive economic development.

Contrastingly, Switzerland experiences a notable increase in foreign investments, with a 50 per cent rise in new projects in 2023, according to consulting firm EY. The influx of investments resulted in the creation of 1,781 new jobs, demonstrating Switzerland’s growing appeal to international investors despite a general decline in foreign investment across Europe.

Hong Kong’s role as a financial hub was under scrutiny following the passage of the Safeguarding National Security Ordinance. This legislation raised concerns about human rights and business sentiment, with G7 representatives warning that the new law could hinder business operations and international exchanges. Despite these challenges, top finance officials emphasised Hong Kong’s strategic position and its potential benefit from China’s economic transformations and the internationalisation of Yuan.

Additionally, significant corporate moves were observed, with the Wall Street Journal relocating its Asia headquarters from Hong Kong to Singapore, citing the new security law as a contributing factor to the declining business environment in Hong Kong. This shift reflects concerns about the impact of political changes on business operations in the region.

Top Stories

Below are our top five stories of the month.

ITV News - Channel Islands to bring in 'pillar two' tax for large companies under new global scheme

The Crown Dependencies, Jersey, Guernsey, and the Isle of Man, have confirmed that they would implement the ‘pillar two’ tax, which is designed to create a level playing field across over 130 jurisdictions. The changes would mean companies based in the islands with a turnover of more than €750 million would be taxed at 15 per cent from 2025. This will enhance the islands’ reputations by following international tax norms and tackling what is described as ‘profit shifting’.

Canadian Lawyer Magazine - New security law raises concerns amid decline in Hong Kong business sentiment

Hong Kong’s Legislative Council unanimously passed the Safeguarding National Security Ordinance, sparking concerns about human rights and the rule of law. The ordinance addresses five types of crimes: treason, insurrection and incitement to mutiny, theft of state secrets and espionage, sabotage, and external interference. Penalties for some crimes have been increased, with a greater focus on crimes involving foreign parties. G7 representatives argued that the new law would hinder business operations and open exchanges with the wider world, urging China to uphold its commitments under the Sino-British Joint Declaration and the Basic Law.

BVI News - Too hard to do business in BVI

Social commentator Claude Skelton Cline has argued that doing business in the BVI is becoming increasingly difficult. Speaking on his Honestly Speaking radio show, Skelton Cline highlighted several challenges that entrepreneurs face in the territory. The talk show host pointed to the bureaucracy and red tape that continued to stifle business growth and innovation and highlighted the need for a more efficient system to support local businesses.

Swiss Info - Sharp rise in foreign investments in Switzerland in 2023

The number of foreign investment projects across Europe fell by 4 per cent, while in Switzerland it increased by over 50 per cent to 89 projects, consulting firm EY said on Thursday. The number of new jobs created by such foreign investments increased more than fivefold year-on-year to 1,781. In terms of the number of new investment projects in Europe, the country ranking is led by France and the UK, with Germany as the largest single economy in Europe in third place. Switzerland is 12th. US companies were the biggest source of investment.

South China Morning Post - ‘China’s London’? Hong Kong’s finance hub status will be cemented by mainland’s economic development, summit told

Hong Kong's status as an international financial centre will be reinforced by yuan internationalisation and China's economic transformations, according to top finance officials and industry players. Despite facing "unprecedented changes", Hong Kong's connectivity with mainland China and potential to tap growing opportunities arising from the increased use of the mainland currency globally will consolidate and enhance the city's unique status, claimed Deputy Financial Secretary Michael Wong Wai-lun.